straight life policy term

It usually develops cash value by the end of the third policy year C. Whole life insurance or whole of life assurance in the Commonwealth of Nations sometimes called straight life or ordinary life is a life insurance policy which is guaranteed to remain in force for the insureds entire lifetime provided required premiums are paid or to the maturity date.

ALimited pay whole life.

. Like all annuities one may buy the plan with a lump sum or with a series of payments over a number of years usually ending around retirement. Straight life policy vs. However 20-year limited pay life policies are designed so that the premiums for coverage will be completely paid for in 20 years.

The face value of the policy is paid to the insured at age 100 B. For most people this is preferable as you have the coverage while you need it most. A father who dies within 3 years after purchasing a life insurance policy on his infant daughter can have the policy premiums waived under which provision.

There are four more options for the same whole-life policy. This phrase implies that premiums for the plan will remain constant and they will not rise or fall over the duration of the policy. 10-year Renewable and Convertible Term Life Paid-Up at Age 70 Straight Whole Life Renewable Term to Age 100.

Your client wants both protection and savings from the insurance and is willing to pay premiums until retirement at age 65. What is a Straight Life Policy. For example you could have a 100000 straight life insurance policy for which you pay 30 a month.

Earnings per share EPS Beta Market. After death however the payments cease and the policyholder does not name a beneficiary. Credit life policies are typically issued for a period of 10 years or less.

It has the lowest annual premium of the three types of Whole Life Policies D. Like other forms of whole life insurance the death benefit of a straight life policy is guaranteed to remain in place for life if premiums are paid. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy.

Continuously premium straight life policies are designed so that the premiums for coverage will be completely paid for by the insureds age of 100. This terminology denotes that premiums for the plan will be level meaning they will not increase or decrease during the life of the policy. The term straight refers to the whole life insurance policys premium structure.

Credit life insurance is only sold through a group policy. Upon expiration the policyholder may decide to renew the policy or allow it to lapse. Term life policy While straight life insurance offers lifelong coverage term life insurance provides temporary life insurance coverage.

Life Paid-Up at Age 70. IRMI offers the most exhaustive resource of definitions and other help to insurance professionals found anywhere. When applied to Whole Life insurance the word straight denotes.

Straight life or economatic life insurance may be used to cover a debt. What Does Whole Life Insurance Mean. A life insurance policy that provides coverage only for a certain period of time.

Term Ticket Model In the Distribution world Straight Through Processing was defined as a Drop-Ticket or Term-Ticket during its peak years from 2011-2016running a term insurance quote then clicking a button to do an abbreviated eApp and then ePolicy delivery. The duration of premium payments. Term life insurance covers you for a specific number of years usually 10 20 or 30 years while whole life insurance covers you for life as long as you keep up with your premiums.

An annuity or other insurance plan that provides the policyholder with monthly payments for the remainder of hisher life. Straight life insurance is. A straight term insurance policy provides a benefit upon the death of the policyholder but ceases to provide this benefit if heshe is still alive when the policy expires.

As with all whole life insurance contracts at age 100 the policy cash value will be equal to the face amount of the contract less any loans and interest not repaid by the policy owner. Premium payments are level. To save money you decide to purchase a much shorter term life insurance policy but that can be a really bad idea since it is such a short policy length.

Its premium steadily decreases over time in response to its growing. Agents can sell term life insurance that is all risk with no cash value. At any time the face amount of the policy cannot be greater than the amount of the debt.

Straight Term Insurance Policy. It is highly recommended you get a minimum 20 to 30-year term life insurance policy. A term ticket is not a full eApp.

What would be the right policy for this client. A term policy is designed for short-term needs. Other permanent life insurance plans such as adjustable life insurance can have a premium structure that changes over time.

Straight Whole Life Insuranceor ordinary life provides permanent level protection with level premiums from the time the policy is issued until the insureds death. Rates for a 10-year term will be less compared to rates for 30 years or the 20-year term life insurance policy. Whole life insurance is a type of life insurance that provides coverage for the entirety of the policyholders life and has a savings component.

A term can be straight term annual monthly renewable 5 years renewable 10 year renewal straight decreasing or mortgage decreasing. Straight refers to the premium structure of the whole life insurance policy. There are many options.

Click to go to the 1 insurance dictionary on the web. Which statement is NOT true regarding a Straight Life policy. It pays out a death benefit upon the policyholders death and it accumulates cash value over time that the policyholder may withdraw for personal use or borrow against.

Straight whole life policies have a level guaranteed face amount and a level premium for the life of the insured. Looking for information on Straight Life Policy. Straight life insurance is a type of whole life insurance.

Most term life insurance policies offer a level death benefit and premiums for 10 to 30 years though some companies offer coverage for five years and as much as 40 years. Straight term insurance policy Term life insurance policy providing a fixed-amount death benefit over a certain number of years. They wont go up regardless of age or health.

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a. All of these insurance products require an agent to have proper FINRA securities registration in order to sell them EXCEPT for.

Lcx Life A Life Insurance Settlement Company Life Life Insurance Health Challenge

/LinearRelationshipDefinition2-a62b18ef1633418da1127aa7608b87a2.png)

Linear Relationship Definition

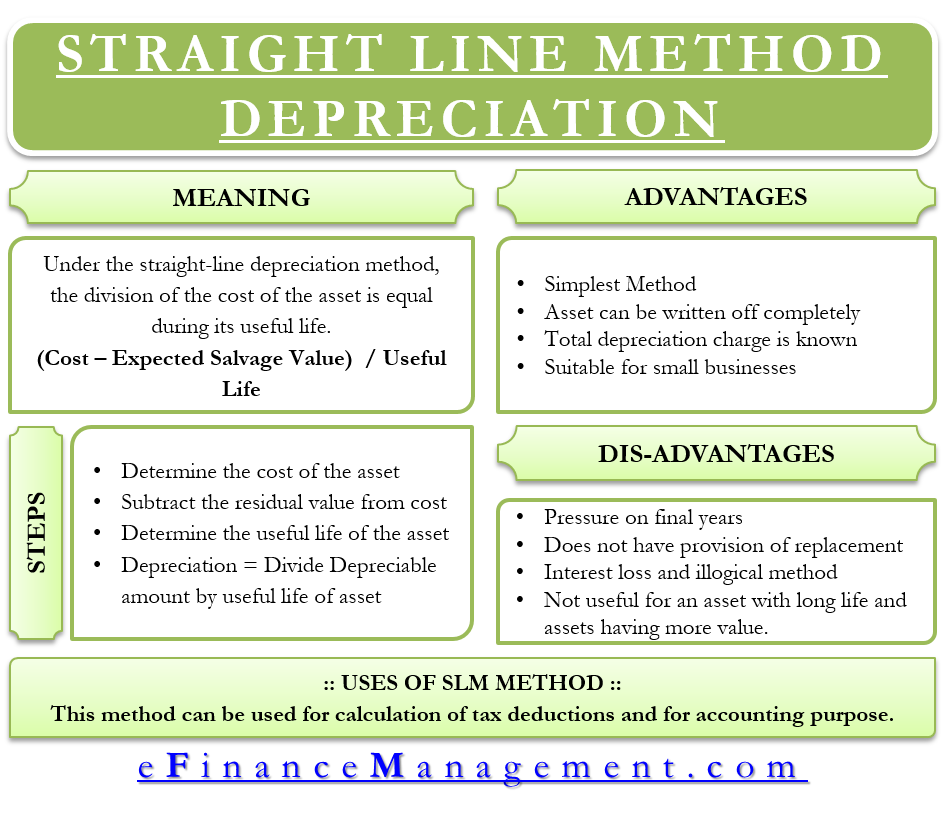

Straight Line Depreciation Efinancemanagement

How Return Of Premium Life Insurance Works Nerdwallet

Bestow Life Insurance Login How To Sign In To Your Bestow Member Portal Insurance Diaries Life And Health Insurance Life Insurance Life Insurance Companies

Period Certain Annuity What It Is Benefits And Drawbacks

Annuity Payout Options Immediate Vs Deferred Annuities

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

Life Insurance Converage Life Insurance Quotes Life And Health Insurance Life Insurance Marketing Ideas

Straight Life Annuity Definition

Joint And Survivor Annuity The Benefits And Disadvantages

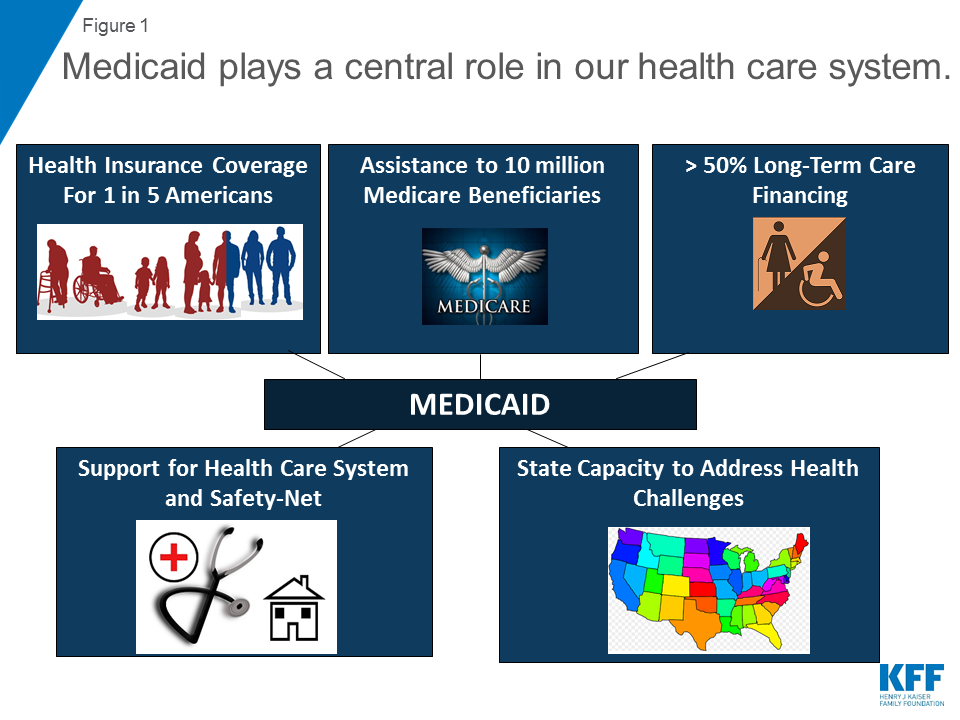

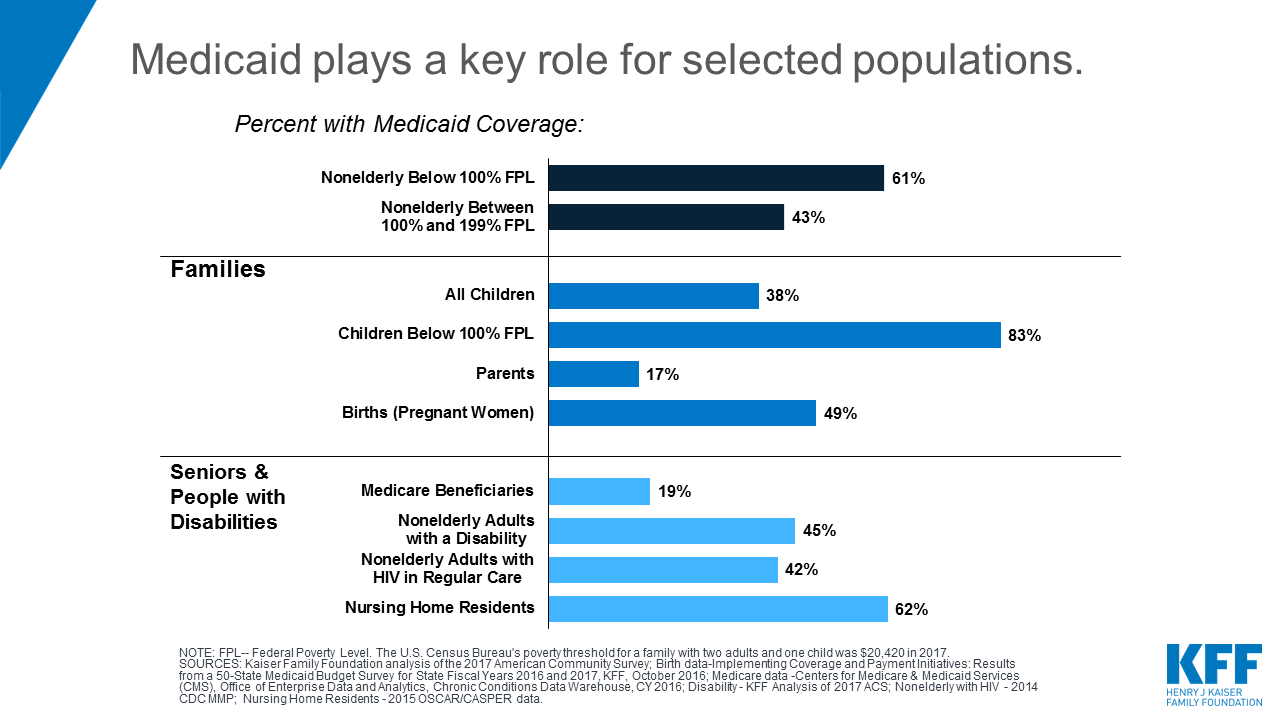

10 Things To Know About Medicaid Setting The Facts Straight Kff

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

When Can You Cash Out An Annuity Getting Money From An Annuity

Looking For The Best Rates On Life Insurance For All 50 States We Can Help In 2021 Insurance Life Insurance Exam

Annuity Payout Options Immediate Vs Deferred Annuities

Straight Line Depreciation Formula Guide To Calculate Depreciation

10 Things To Know About Medicaid Setting The Facts Straight Kff

/GettyImages-184985261-257061c6b35546779a16b51ca1e9da8e.jpg)